★★★★★ Rated 4.8/5 by 22,000+ Customers

🇺🇸 Serving American Businesses 🇺🇸

We Provide Loans Up To $5 Million Without Personal Guarantees

We issue over 1,400 loans each month. We do not spam call or sell your info to anyone else.

22,000+ Happy Customers

We provide loans to small business owners in all 50 US states.

★★★★★ 5 Stars

We had the revenue, but we didn't have the cash flow. We needed a new piece of equipments and when traditional banks turned us down, they got the job done.

Their team was friendly and professional. My all-in rate was transparent as soon as I was approved and I was surprised that I didn't even need to have a personal guarantee. I got the loan completely on the merits of my business.

Robert - Marra Flooring

★★★★★ 5 Stars

Because our business was relatively new, traditional banks kept turning us away. We had strong growth but couldn’t get the financing we needed for inventory.

Their team focused on our increasing orders and revenue to get us the funding we needed. The process was fast and easy. Highly recommended for companies that need to grow but don't have the cash.

Justin - Charmac Trailers

★★★★★ 5 Stars

Traditional banks turned us down because we had no property to offer as collateral for our kitchen renovation.

Their merchant cash advance used our daily sales history instead of demanding physical assets.

The funds arrived within a couple of days, and the percentage-based repayments meant we paid less during slow weeks.

Jamie - Basic Burger

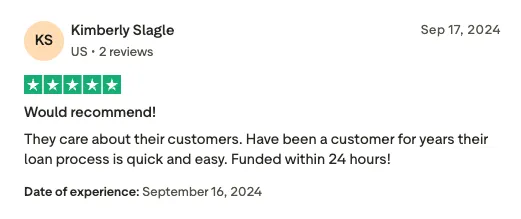

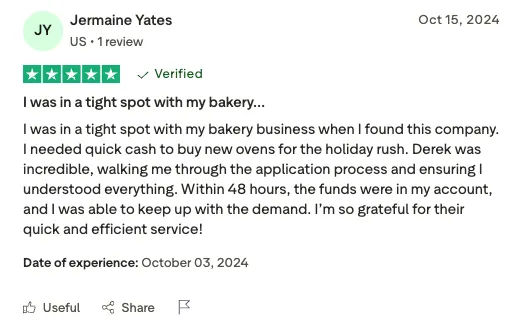

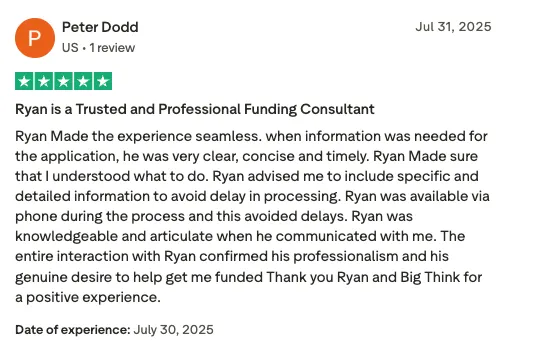

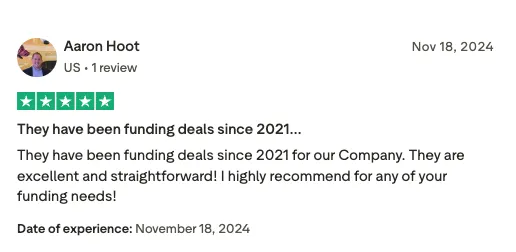

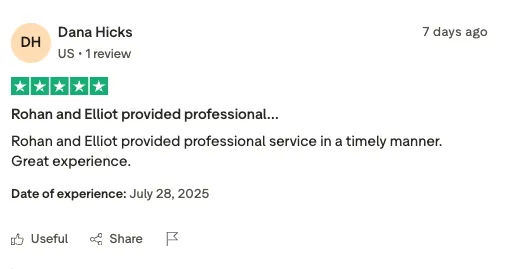

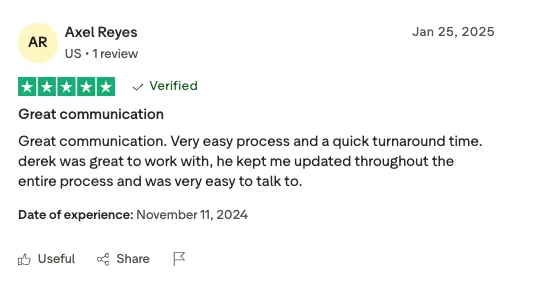

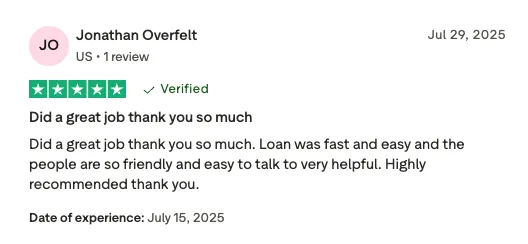

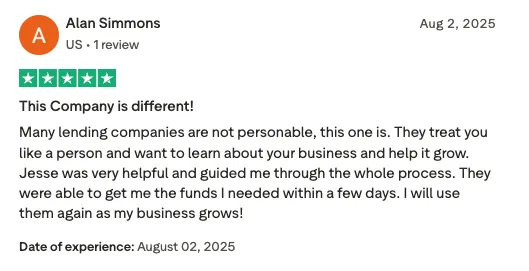

Thousands Of Five Star Reviews

We provide loans to small business owners in all 50 US states.

Questions & Answers

Is there a personal guarantee?

No personal guarantee needed - your business qualifies on its own merits.

Is this secured or unsecured financing?

Unsecured financing with no required collateral. Having assets can increase your approval amount and lower rates.

Is there a prepayment penalty?

No penalties - we reward early repayment with discounted rates!

How frequently will I make payments?

Choose from weekly, bi-weekly, or monthly payment schedules.

What interest rate will I receive?

Rates vary by program and are tailored to your specific business profile.

What are terms for repayment?

Flexible terms customized to match your business needs and cash flow.

What will my total repayment amount be?

Total repayment is transparent and varies by program, with all costs clearly outlined upfront.

Can I adjust my borrowing amount?

Rates vary by program and are tailored to your specific business profile.

How long does the offer stand?

Valid for 90 days, with updated bank statements required every 15 days to verify business conditions remain stable.